Today I look at the broader question of “Will Housing Prices Cancel Out Low Mortgage Rates?” I stumbled upon a great Realtor.com article that I’d like to share with you. This article covers the national economy and the real estate economy.

The economy is on a slow path to recovery. A report on regional economic conditions shows a flattening of retail sales and the restaurant and hospitality industry struggling to survive. Local and regional banks are worried about rising delinquency rates.

An encouraging sign is that the weekly unemployment rates have declined. We lost 22 million jobs because of COVID-19, yet we’ve managed to bring 11 million of those back very quickly.

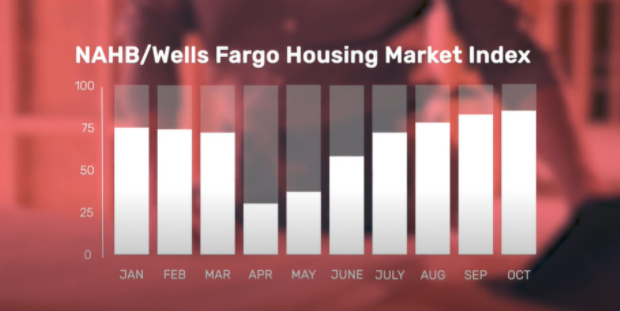

On the real estate side of things, there’s a brighter picture nationally. For year over year, new construction through September permits are up 8.1%, starts are up 11.1% and completions are up 25.8%. Because of the strong demand, home builders are much more optimistic about the outlook and are increasing their pace.

All the while inventory nationally and locally has dropped to a new low, this, in turn, has pushed prices nearly 15% higher from a year ago.

More recent data from Realtor.com showed the pace of activity may actually be slowing down in October. The housing recovery index shows demand is strong. Yet new supply, the pace of sales, and listing prices are moderating.

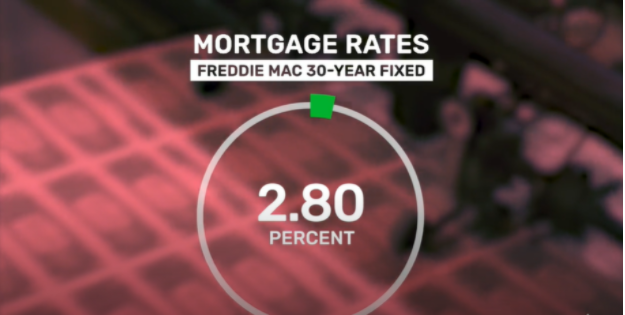

Mortgage rates have reached a new record low in the 3rd week of October, marking this the 11th in 2020 time mortgage rates have reached all-time lows in 2020. Truly, unbelievable.

However, with prices still outpacing buyer’s earnings, we are nearing the tipping point where the benefit of low-interest rates will be erased by pricing increases. The affordability index for housing still remains low but will have a hard time keeping up if prices continue to rise by 15% a year. In a normal market, we expect real estate to appreciate around 3% above inflationary rates. We’ll talk about the affordability and the affordability index in next week’s blog.

In the meantime, if you have any tough questions you’d like me to cover on our next blog, send me an email. We love a good challenge and engagement from our audience.