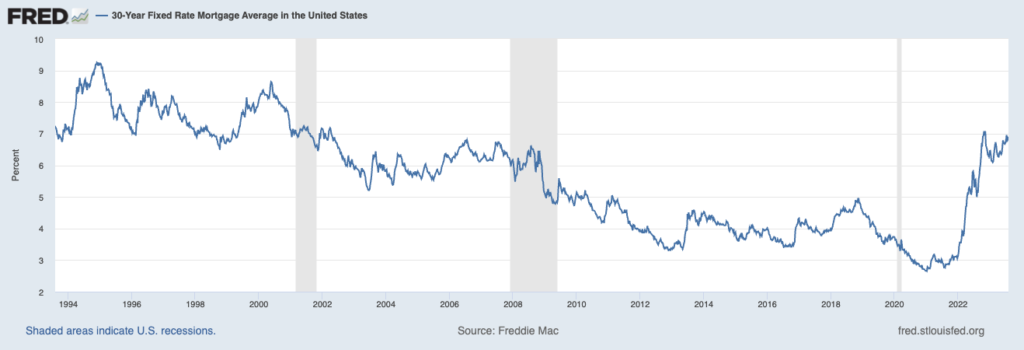

Buying a home is a big investment, and one of the most significant factors to consider is the interest rate. With the Federal Reserve increasing interest rates multiple times this year and set to continue in 2022, many Salt Lake buyers are worried about what happens if the rate goes up or down while they are under contract. Will they end up paying more than they budgeted for?! Is there any way to protect themselves? In this post, we’ll go over everything you need to know about interest rates and your contract to help you make an informed decision when buying your Salt Lake City home.

If you are in search of a reputable lender, we have worked with many and can connect you with the top Salt Lake City lenders.

When you start shopping for a mortgage, your lender will provide you with an interest rate quote, which will be valid for a certain period. If the rate goes up after you’ve locked in your rate, your mortgage payment will increase, and you could end up paying thousands of dollars more over the life of your loan. To prevent your rate from increasing, you should get a mortgage rate lock as soon as possible. A rate lock is a commitment from the lender to hold your interest rate for a certain period, usually 30, 45, or 60 days. If the rate goes up during this period, you are protected from the increase.

However, a rate lock is not foolproof, and there are certain situations where your rate could still go up. For example, if your loan takes longer to close than the rate lock period, you may need to pay an extension fee or get a new rate lock at a higher rate. Additionally, if your loan application changes significantly, such as if you switch from a fixed-rate to an adjustable-rate mortgage, your lender may require a new rate lock at a different rate.

To protect yourself further, you can ask your lender if they provide a float-down option. A float-down option is an add-on to your mortgage rate lock that allows your interest rate to lower if market rates begin to fall again. Essentially, if rates go down after you’ve locked in your rate, you’ll still get the lower rate. This option protects you from rising rates, but with the added benefit of a potential rate decrease if rates drop.

Another option to consider is getting pre-approved for your mortgage. Pre-approval is an important step towards buying a home and involves a lender evaluating your creditworthiness and financial standing to determine how much money they’re willing to lend you. Pre-approval gives you confidence in your purchasing power while also increasing your chances of having your loan approved when you’re ready to make a purchase.

The most important takeaway for buyers is to do their research and work with a qualified lender. It’s crucial to have a clear understanding of all the components of your mortgage rate and be prepared for the possibility of a rate increase. Mortgage rates are subject to change daily and are affected by the economy, inflation, and the Federal Reserve’s policy. However, with the right preparation and a qualified lender on your side, you can navigate the buying process with confidence.

Navigating the home buying process may seem daunting, but understanding your options when it comes to interest rates and your contract is essential. Understanding the ins and outs of mortgage rates, getting pre-approved, and working with a qualified lender can help protect you from potential rate increases and allow you to make an informed decision when buying a home. By taking these steps and doing your research, you can secure the best mortgage rate possible and confidently purchase your dream home.