There has been some recovery since the shutdown, however, the velocity of that recovery has slowed greatly in recent weeks

So there are two sides to every story. The last story spoke mostly to the overall health of our Wasatch Front Real Estate market. Feel free to go back and watch the “Is the Real Estate Market Turning Around” blog.

Now let’s give you the alternative look at what may be problematic for the health of our real estate market.

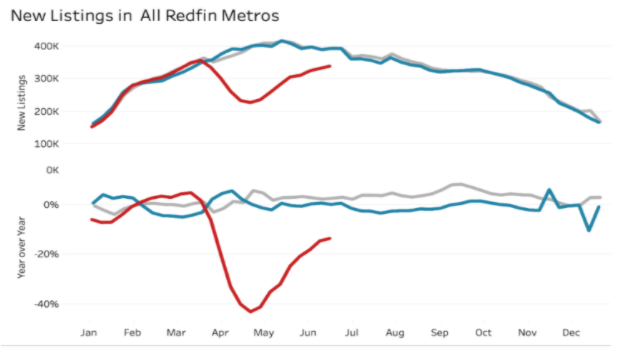

According to a recent report by Inman New’s Mike DelPrete new listings coming available to the market have dropped by 40% nationally. There has been some recovery since the shutdown, however, the velocity of that recovery has slowed greatly in recent weeks and we are still down 18% nationally over last year’s numbers.

The problem here is that when new listings stop coming to market, overall supply drops. There are fewer homes available for buyers to choose from and ultimately purchase.

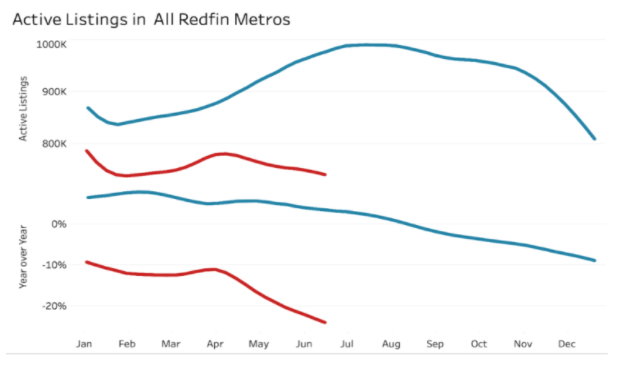

Nationally, the number of active listings is down 25% as of June 21. The slope of the line is the bad news, as you can see it is heading down and heading down far quicker than it did this same time period last year.

Now look at our Utah market’s Active Listings image and you can see that we are down 37% in active listings available over this time last year. This is the time of year in Utah that we’d normally see a trend upward in active listings, however, the trend is the opposite of what we need.

The active listings across Utah are very much on a downward slope, a mirror opposite of what we saw this same time last year. This is not unique to Utah. A strikingly similar downward sloping trend is seen in many of the major metropolitan areas across the country. In fact, active listings have simply plummeted nationwide in the last few weeks.

Why is this significant? Because a drop in active listings is a disruption to the market dynamics of supply and demand. If the amount of active buyers remains constant and the inventory drops, home prices will rise. Which, if you’re a seller, can be a good thing but if our market is driven by those willing to buy. The willingness to buy will begin to decrease as buyers become frustrated and “burned-out” in competing with offers on every property and ultimately drop out. Supply and demand will change as motivation changes with buyer’s willingness to buy. Fewer buyers will begin to tilt the scales of the economy the other direction.

That is a distinct possibility and one we will need to pay close attention to. Real Estate dynamics typically take around 90 days to show up. Meaning the activity or lack of activity we see today could show us more in terms of motivation in 90 days. That coupled with an increase in COVID-19 cases throughout Utah and most of the countries could be problematic for the health of real estate.

So there you have it, two potential and very different outcomes could show up in the next 90 days based upon the two most recent blogs that I’ve written. Now you know I can’t tell the future, but I can tell you if you’re looking to sell, now is a very good time to do that. If you’re looking to buy, as many are, make sure you’re working with a competent lender as well as a very good buyer’s specialist to help you navigate these difficult waters. With interest rates near 3%, if you can buy, then buy now.

If you need to talk with a skilled agent and ask questions about your own real estate goals, please don’t hesitate to give us a call. There’s no pressure to buy, sell, or any long term contracts you’ll need to worry about. And, we’ll keep our conversations confidential. Give me a ring or send me an email and you’ll be amazed at how fast we get back to you.