The real estate market is on a much stronger footing which will serve it well in any future recessions.

First, we should define what exactly a recession is.

Simply put, a recession is a time in which the economy stops growing.

Recessions are normal and inevitable and they can make home buyers or sellers understandably weary. The job market becomes less stable, lending standards can tighten, and overall consumer confidence changes. Well, what goes up, must come down…right? Or is that the case?

We’ve been on a tear of a run since 2011 in terms of Utah housing, which increases across the board. It has to slow down sometime, perhaps even take a dip. We know that COVID-19 will cause a recession at this point. We don’t know how long or how deep, but we know when more than 30 million Americans are out of work, we’ll have a recession. So how will that affect the housing market?

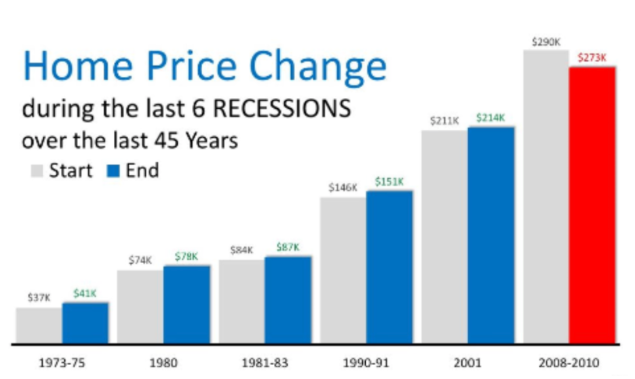

I can’t predict the future, but I can analyze the past. We’ve had 6 other recessions since 1973. 5 out of 6 of those recessions, housing prices surprisingly went up. It was only the 2008 Great Recession where the real estate bubble popped. Of course, this was driven by easy money, fog-a-mirror-get-a-mortgage types of folks. Many of whom were speculating on appreciation and quick sales. This created an unrealistic demand for housing by individuals and investors who couldn’t make, and many times had no plans of making their mortgage payments.

Today, money is not as easy to come by. Lending standards measured by the Mortgage Credit Availability Index were extremely high from 2004-2007. Stated income-stated asset loans were the norm. Rarely did anyone have to actually document the ability to repay the loans they were committing to.

The lending standards today remain far below the normal standard. As a result, foreclosures are currently near record lows. And, 59% of homeowners in America today have equity in their homes.

Now you have to fully document income and assets to go along with tighter credit standards in order to get approved for a mortgage. This means the real estate market is on a much stronger footing which will serve it well in any future recessions. Now is still a good time to buy or build a house in most markets, or renovate an existing home. And, it is most certainly an opportune time to sell if you are looking to maximize your equity as inventory levels across the Wasatch Front are at record lows.