Today I want to share some national numbers with you so we can see how unemployment and our current economy are shaping the real estate market.

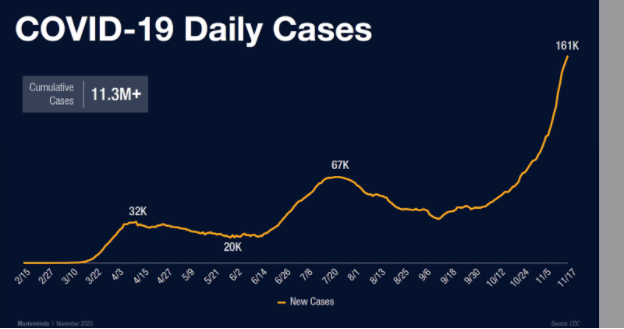

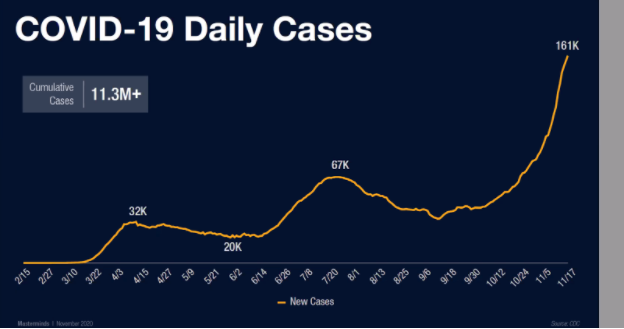

First, we should start with COVID. It’s not news that cases have skyrocketed over the past 2 months. The good news is that two vaccines and an accurate home test will be available by spring or summer. When the vaccines become available they will most likely go immediately to the hospital and medical workers, our front line. They’ll then be given to people that are sick or at risk. Then the education system. Then we’re not sure what will happen. It will take a year or more to get the vaccine out and tests in a way that will make a big difference. 2021 is the pivot year and 2022 will be an important year for focus and staying ahead of the curve with our economy. 2023 is likely when things will begin to normalize.

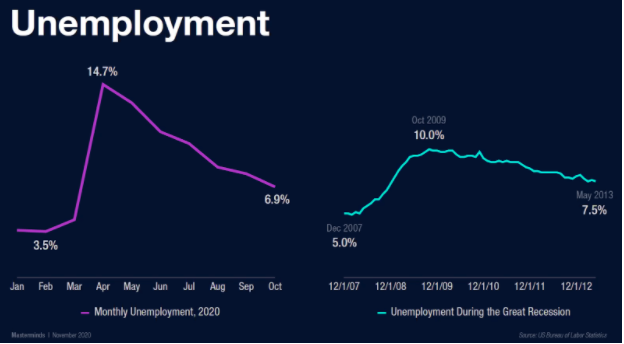

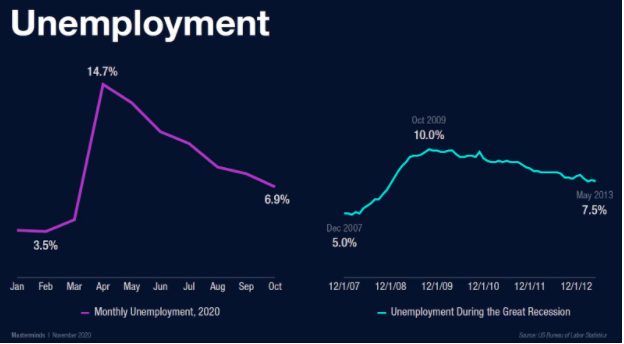

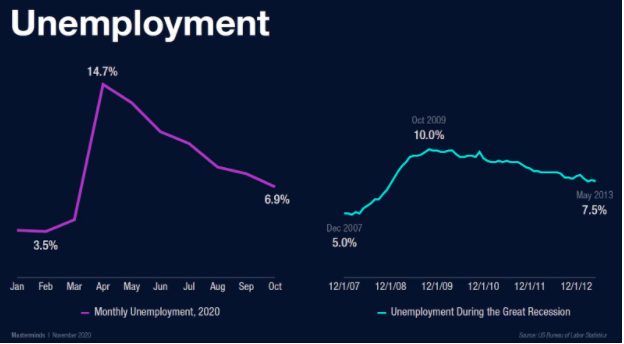

This image demonstrates our national unemployment rates currently in purple. And the teal line is a comparison of what unemployment rates looked like during the great recession. It is considered acceptable unemployment when our rates are below 6%. So we’re not quite there yet. But look at how quickly we’ve snapped back with jobs in comparison to the long drawn out rates during the Great Recession which was the longest recovery ever for a recession. Quite unlike our 2-month recession of 2020.

This image shows us the industries hit hardest by the 2020 recession. You can see that there are really 3 industries that will need a lot of attention in order to bounce back: Retail, Leisure & Hospitality and Transportation. These are also where people “get together” the most. So hopefully with the vaccine, quicker, more accessible, and more accurate testing, we’ll see those industries begin to rebound. An interesting side note here, people are saving money at a higher rate than ever. They have discretionary income. But they’re not going out to eat, not traveling on planes, and not going into retail outlets.

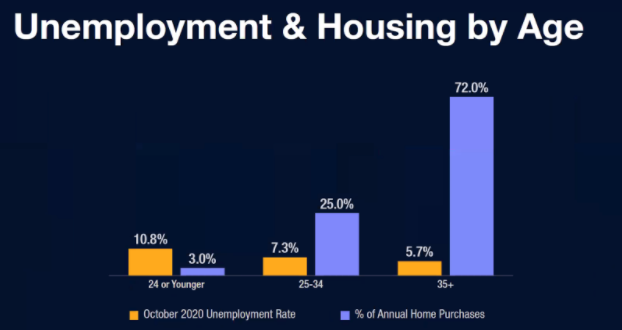

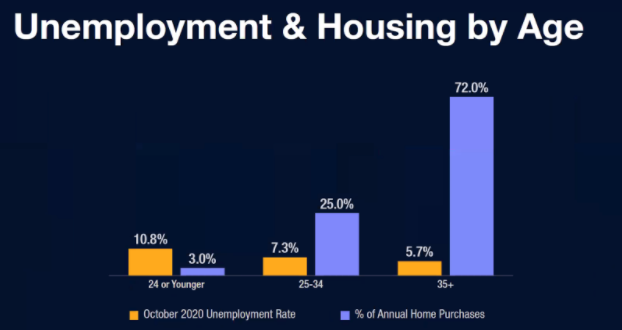

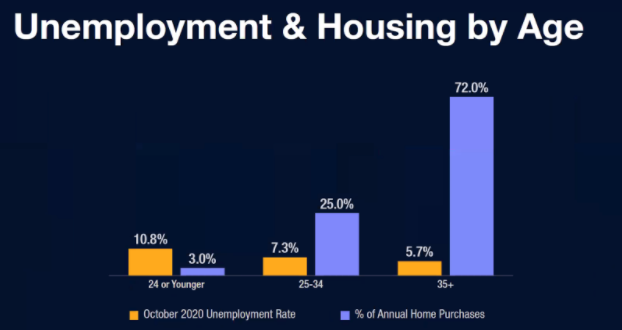

This graph is updated and shows us unemployment and Housing by Age. The 25-34 age group has 7.3% not a great number, but not a horrible recession type number. The 35+ group has 5.7% and remember the number is 6% and above that, we start to have issues with unemployment. The youngest are hit the hardest but yet they’re not the primary home buyers. This is one of the reasons why the housing market has remained so strong.

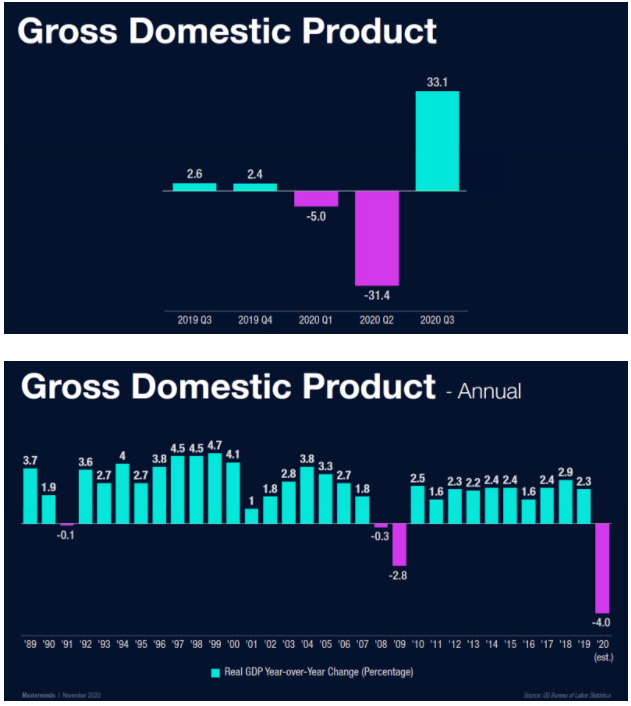

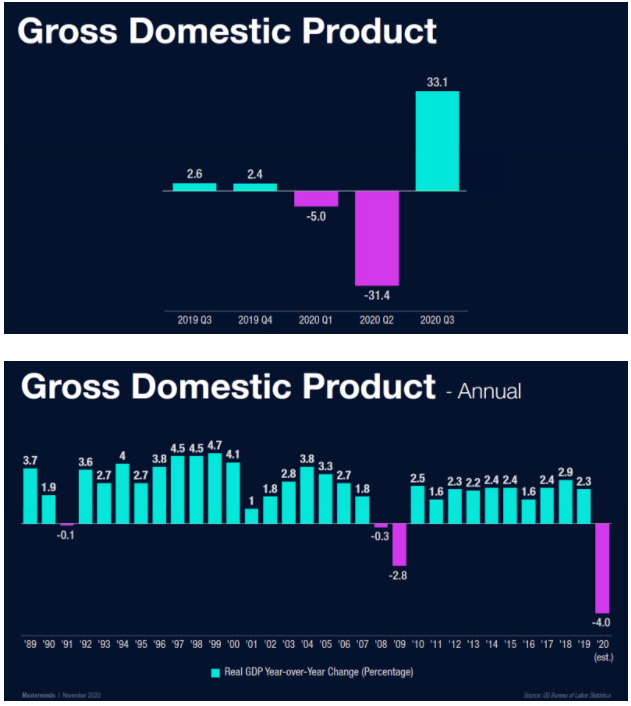

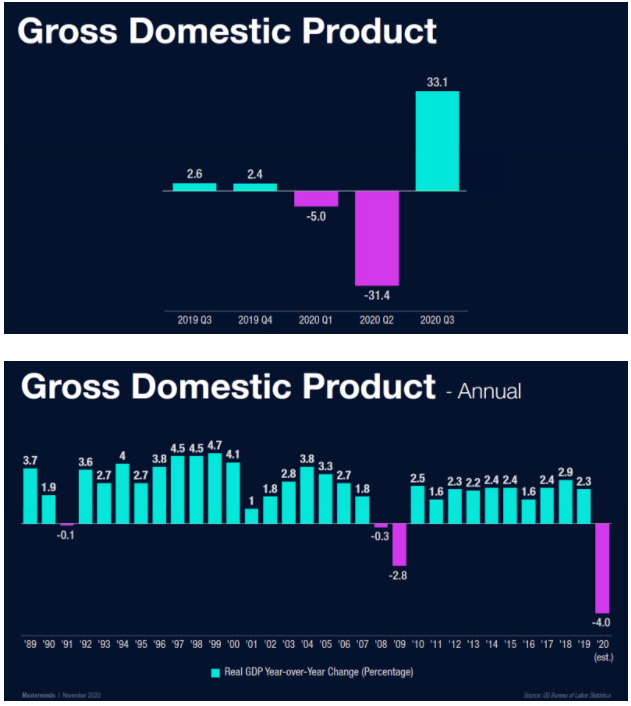

It is considered a healthy economy when our Gross Domestic Product is around 2. The last 2 quarters of 2019 are really good. We got hit by an asteroid. With the stimulus, our economy came roaring back. This also gives us some perspective from 1989. There is no worse overall GDP than where we are currently. This is a really tough spot to be in. The question is what will happen next year. We think that 2021 is a “solutions year” where we begin to dig ourselves out of this mess. 2022 is when the solutions are mainstream. 2022-2023 we begin to breathe and move about the country.

The thing of it is, that real estate nationally is doing better than any prior recorded year. In fact, nationally we are 2.3% higher in sales than we were in 2019.

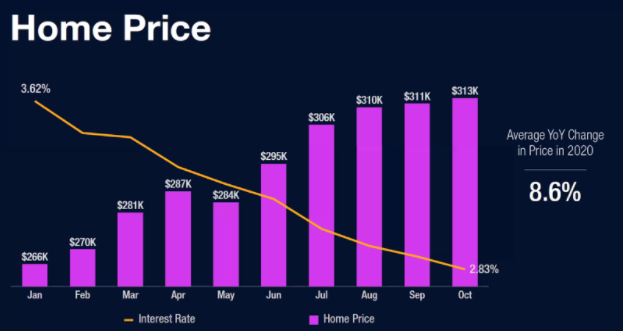

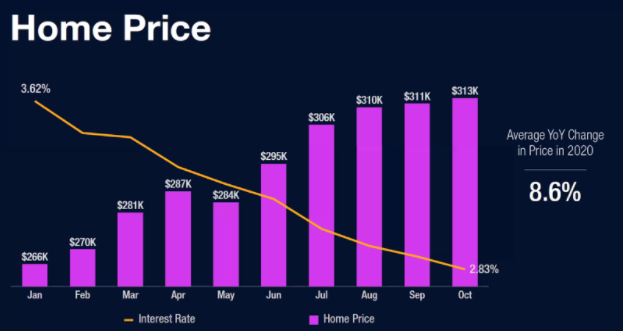

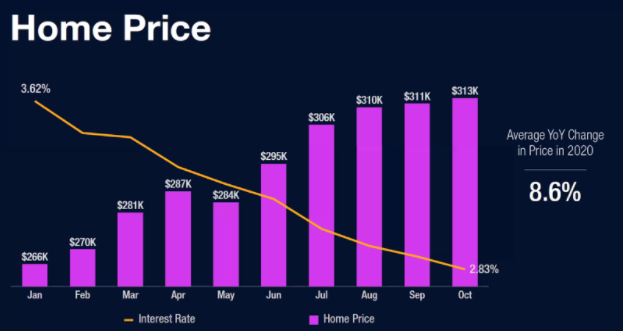

You can see that national home price averages are up considerably. And the orange line demonstrates the interest rates which have been driving a lot of the purchasing decisions for home buyers. Interest rates have hit historic lows a dozen times since the beginning of the year. As I write this blog the interest rate is 2.5%. We really need to get the entry-level buyers back into the market.

Since the beginning of time, well-located real estate simply appreciates. That’s a fundamental truth. If you’re buying real estate that isn’t a great location, you’ll need to plan on holding onto that real estate for 10+ years. Otherwise, you’ll likely continue to see price increases across the board. The biggest challenge buyers are facing in getting their offers accepted.

So Inflation, Employment, and GDP are the Government’s tracker. GDP of 2% or more.

Inflation at 2% or less. Unemployment rates at 6% or less. The cost of money, regulation, and monetary policy (the ability to print money) are the tools the government will use to assist the economy. With Biden’s win, we’ll likely see interest begin to go up as Democrats work to control inflation.

The truth is moderately higher interest rates aren’t necessarily a bad thing in the long run.

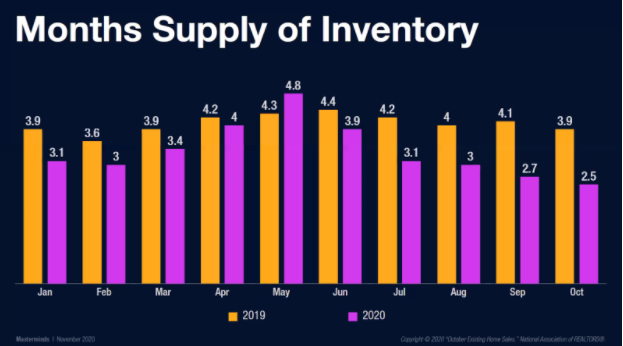

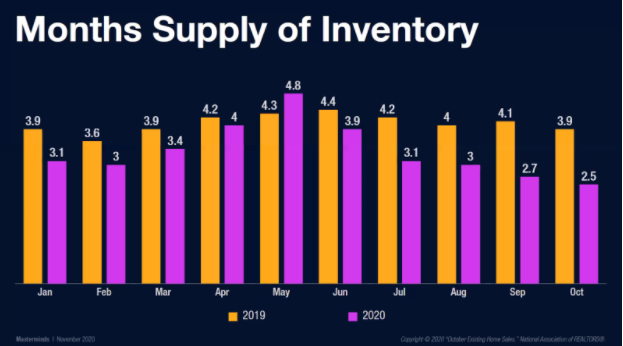

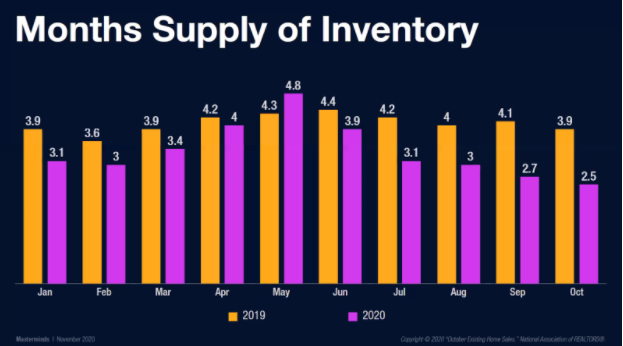

Nationally our housing inventory levels are at record lows. We were already low on housing inventory in 2019. Now look at the purple side of the graph, that’s this year’s inventory levels nationally. In Utah, we are at 1.5 months supply. To put this in perspective, a normal market will have a 4-6 months supply of inventory. We’re still well short of where we should be in terms of new construction housing starts. We’ve been off by 2+ million since the end of the recession and we just haven’t seemed to pick things up at a quick enough clip for the buyers who are entering into homeownership.

Finally, we can take a look at loan delinquency rates. Normal delinquency rates are about 1% historically. We had 9.5% loan delinquency rates during the height of the Great Recession. 50% of all sales nationally were Short Sales or Foreclosures. This time around more people have more equity. We are hoping to see these delinquency rates fall even more as the economy slowly reopens. We know many are in Forbearance as part of the Care Act to avoid foreclosure. We know that most of those in forbearance are in those industries that have been most affected by the COVID pandemic.

If you have any tough real estate questions we can handle on our blog, send us an email. If you’re needing help with your own real estate goals, please give us a call.

Today I want to share some national numbers with you so we can see how unemployment and our current economy are shaping the real estate market.

First, we should start with COVID. It’s not news that cases have skyrocketed over the past 2 months. The good news is that two vaccines and an accurate home test will be available by spring or summer. When the vaccines become available they will most likely go immediately to the hospital and medical workers, our front line. They’ll then be given to people that are sick or at risk. Then the education system. Then we’re not sure what will happen. It will take a year or more to get the vaccine out and tests in a way that will make a big difference. 2021 is the pivot year and 2022 will be an important year for focus and staying ahead of the curve with our economy. 2023 is likely when things will begin to normalize.

This image demonstrates our national unemployment rates currently in purple. And the teal line is a comparison of what unemployment rates looked like during the great recession. It is considered acceptable unemployment when our rates are below 6%. So we’re not quite there yet. But look at how quickly we’ve snapped back with jobs in comparison to the long drawn out rates during the Great Recession which was the longest recovery ever for a recession. Quite unlike our 2-month recession of 2020.

This image shows us the industries hit hardest by the 2020 recession. You can see that there are really 3 industries that will need a lot of attention in order to bounce back: Retail, Leisure & Hospitality and Transportation. These are also where people “get together” the most. So hopefully with the vaccine, quicker, more accessible, and more accurate testing, we’ll see those industries begin to rebound. An interesting side note here, people are saving money at a higher rate than ever. They have discretionary income. But they’re not going out to eat, not traveling on planes, and not going into retail outlets.

This graph is updated and shows us unemployment and Housing by Age. The 25-34 age group has 7.3% not a great number, but not a horrible recession type number. The 35+ group has 5.7% and remember the number is 6% and above that, we start to have issues with unemployment. The youngest are hit the hardest but yet they’re not the primary home buyers. This is one of the reasons why the housing market has remained so strong.

It is considered a healthy economy when our Gross Domestic Product is around 2. The last 2 quarters of 2019 are really good. We got hit by an asteroid. With the stimulus, our economy came roaring back. This also gives us some perspective from 1989. There is no worse overall GDP than where we are currently. This is a really tough spot to be in. The question is what will happen next year. We think that 2021 is a “solutions year” where we begin to dig ourselves out of this mess. 2022 is when the solutions are mainstream. 2022-2023 we begin to breathe and move about the country.

The thing of it is, that real estate nationally is doing better than any prior recorded year. In fact, nationally we are 2.3% higher in sales than we were in 2019.

You can see that national home price averages are up considerably. And the orange line demonstrates the interest rates which have been driving a lot of the purchasing decisions for home buyers. Interest rates have hit historic lows a dozen times since the beginning of the year. As I write this blog the interest rate is 2.5%. We really need to get the entry-level buyers back into the market.

Since the beginning of time, well-located real estate simply appreciates. That’s a fundamental truth. If you’re buying real estate that isn’t a great location, you’ll need to plan on holding onto that real estate for 10+ years. Otherwise, you’ll likely continue to see price increases across the board. The biggest challenge buyers are facing in getting their offers accepted.

So Inflation, Employment, and GDP are the Government’s tracker. GDP of 2% or more.

Inflation at 2% or less. Unemployment rates at 6% or less. The cost of money, regulation, and monetary policy (the ability to print money) are the tools the government will use to assist the economy. With Biden’s win, we’ll likely see interest begin to go up as Democrats work to control inflation.

The truth is moderately higher interest rates aren’t necessarily a bad thing in the long run.

Nationally our housing inventory levels are at record lows. We were already low on housing inventory in 2019. Now look at the purple side of the graph, that’s this year’s inventory levels nationally. In Utah, we are at 1.5 months supply. To put this in perspective, a normal market will have a 4-6 months supply of inventory. We’re still well short of where we should be in terms of new construction housing starts. We’ve been off by 2+ million since the end of the recession and we just haven’t seemed to pick things up at a quick enough clip for the buyers who are entering into homeownership.

Finally, we can take a look at loan delinquency rates. Normal delinquency rates are about 1% historically. We had 9.5% loan delinquency rates during the height of the Great Recession. 50% of all sales nationally were Short Sales or Foreclosures. This time around more people have more equity. We are hoping to see these delinquency rates fall even more as the economy slowly reopens. We know many are in Forbearance as part of the Care Act to avoid foreclosure. We know that most of those in forbearance are in those industries that have been most affected by the COVID pandemic.

If you have any tough real estate questions we can handle on our blog, send us an email. If you’re needing help with your own real estate goals, please give us a call.